OMB and Treasury Agree on Process for Issuing New Tax Rules

Changes from April 10, 2018 to April 16, 2018

This page shows textual changes in the document between the two versions indicated in the dates above. Textual matter removed in the later version is indicated with red strikethrough and textual matter added in the later version is indicated with blue.

UPDATE: On April 12, 2018, the Department of the Treasury and the Office of Information and Regulatory Affairs (OIRA) in the Office of Management and Budget (OMB) announced that they reached an agreement on the issue of OIRA review of Internal Revenue Service (IRS) rules. The two agencies signed a new memorandum of agreement (MOA), under which OIRA will review certain significant tax regulations under a specified time limit—generally, not longer than 45 days, but with the potential for an expedited review of up to 10 business days. In addition, within one year after the date of the memorandum, those significant regulatory actions will be subject to the cost-benefit analysis requirements under Executive Order 12866.

A hearing held by the Senate Committee on Homeland Security and Governmental Affairs' Subcommittee on Regulatory Affairs and Federal Management on April 12, 2018, discussed the memorandum in detail and can be viewed at this link.

The original CRS Insight from April 10, 2018, is below.

Media outlets have recently reported that two members of President Trump's Cabinet disagree over the process by which tax-related regulations should be issued. The outcome of this disagreement could have implications for the implementation of the 2017 tax revision (P.L. 115-97). This CRS Insight discusses the historical roots and nature of the disagreement and potential implications.

OIRA Review of Regulations

In 1981, President Ronald Reagan issued Executive Order 12291, which required that regulations issued by most federal agencies be submitted to the Office of Information and Regulatory Affairs (OIRA) in the Office of Management and Budget (OMB) for review. Further, when issuing "major" regulations, agencies were required to conduct a cost-benefit analysis, and they were not permitted to issue regulations whose estimated costs exceeded the estimated benefits. In 1993, President Clinton issued Executive Order 12866, which revoked Executive Order 12291 but maintained most of its requirements, including the requirements for OIRA review and cost-benefit analysis. Executive Order 12866 remains the primary executive order governing presidential review of regulations. (For a more comprehensive history of the role of OIRA, see CRS Report RL32397.)

OIRA review serves several purposes. Perhaps most significantly, it provides a means of presidential control over the content of rules, by providing an opportunity for the White House to ensure that rules are consistent with the presidentPresident's policy preferences. Second, when the executive order's cost-benefit analysis requirements are triggered, OIRA examines the quality of the analysis to ensure the agency followed existing guidance from OMB in conducting the analysis. Finally, OIRA also facilitates an inter-agency review process, during which the rule may be sent to other entities within OMB and the Executive Office of the President.

OIRA Review of Tax Regulations

Since the early 1980s, the IRS has been largely exempted from these OIRA review requirements. In 1983, the Department of the Treasury and OIRA entered into a memorandum of agreement (MOA) that waived, for certain components of Treasury, including the IRS, most of Executive Order 12291's regulatory review requirements. In 1993, after President Clinton issued Executive Order 12866 and revoked Executive Order 12291, Treasury and OIRA reaffirmed most of the underlying exemptions from the 1983 MOA.

Specifically, the agreement waived OIRA review for IRS regulations and certain other types of actions, including revenue rulings, revenue procedures, and legal determinations. Under these terms, most actions taken by the IRS are exempt from OIRA review and cost-benefit analysis requirements, with the exception of "major" or "economically significant" rules. In other words, the most impactful IRS rules—e.g., those that have an annual effect on the economy of $100 million—are still potentially subject to review. (In 2016, for example, the IRS issued rules relating to corporate inversions, which OIRA reviewed.)

However, other IRS practices further expand the scope of the 1983 exemption, making additional IRS rules less likely to be reviewed. As the IRS states in its internal policy on writing rules, IRS rules are generally considered not to have direct economic effects, thereby rarely hitting the $100 million threshold identified above. Further, the IRS states that its regulations "merely implement a statute," meaning that "the effect from a rule in most IRS/Treasury regulations is almost always a result of the underlying statute, rather than the regulation itself." The IRS therefore often describes its rules as interpretive and not significant enough to warrant OIRA review or cost-benefit analysis. Critics of this position, however, point out that the same argument could be made for "virtually any agency implementing a statute."

Recent Discussions over Potential Changes

In recent years, concerns have been raised over the IRS exemption, about which very little information was publicly available. In 2016, Senator Orrin Hatch and several other Members requested a Government Accountability Office (GAO) examination of the exemption. GAO issued its report in September 2016, recommending that "Treasury and OMB reevaluate their long-standing agreement to exempt some tax guidance and regulations from OMB oversight." After the issuance of the GAO report, which discussed the MOA but did not contain a copy of it, Senator Hatch wrote to Treasury requesting a copy of the MOA, which still had not been made public. Treasury released a copy of the MOA soon after. In 2017, GAO stated on its website that Treasury had agreed with its recommendation to revisit the long-standing agreement.

Potential Implications

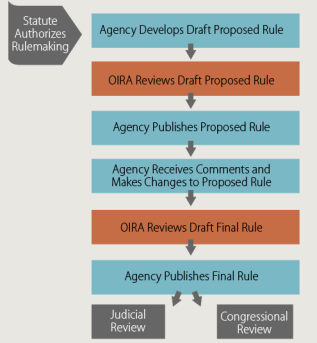

The 2017 tax revision generally went into effect on January 1, 2018. If OIRA review and cost-benefit analysis were to be added to the IRS's rulemaking process, the speed at which the rules implementing the newly enacted tax law can be issued may be affected. OIRA generally reviews rules twice: prior to the agency's issuance of the proposed rule and again before the issuance of the final rule. (See the orange boxes in Figure 1 for a visual depiction of when this review occurs.)

|

|

Source: Graphic created by CRS. |

Under Executive Order 12866, OIRA has up to 90 days to review rules, although review usually takes under 90 days: according to OIRA's website, on average during the Trump Administration, economically significant rules have been under review for 49 days, and noneconomically significant rules for 65 days. In the case of any individual regulation, however, OIRA could potentially expedite review so as to minimize delay of the rule's issuance—or, on the other hand, OIRA could potentially delay issuance of the rule.

In addition, if IRS rules were to become subject to OIRA review, they would likely also be subject to President Trump's "one in, two out" executive order from January 2017. Under that order and its implementing guidance, the compliance costs associated with new regulations are required to be paired with equivalent cost offsets associated with at least two regulations.

Some observers of the regulatory process have argued that conducting a cost-benefit analysis leads to better quality rules, and that OIRA oversight of agencies' cost-benefit analysis provides an extra incentive for agencies to conduct high-quality, robust analyses. Thus, arguably, OIRA review could lead to better quality IRS rules.

Finally, some concerns have been raised that OIRA may not have sufficient expertise to review tax regulations and analyses. Reportedly, however, OIRA is looking to hire individuals with relevant expertise.